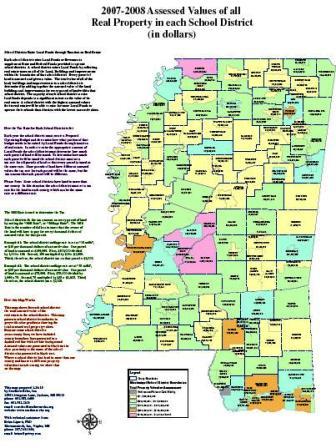

- MS School Districts — Map of Assessed Values of Real Property

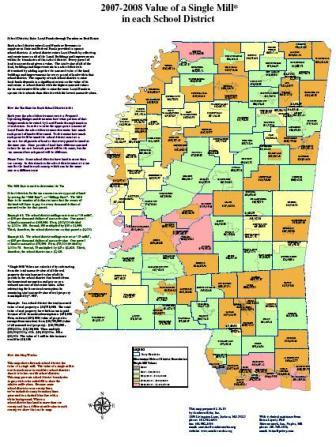

- MS School Districts – Map of the Value of a Single Mill

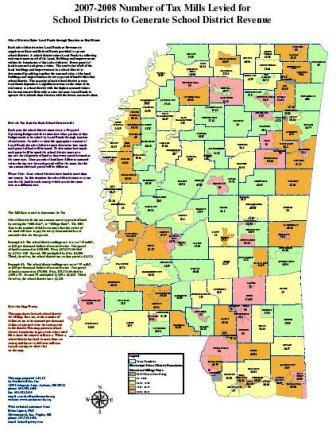

- MS School Districts — Map of the Number of Mills Assessed to Raise Taxes

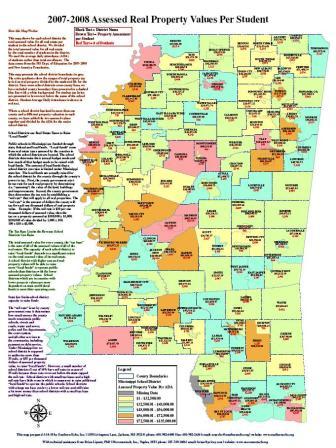

- Map of Property Assessment Values per Student by School District

- Map of Taxes Levied per Student by School District

Map Descriptions

|

MS School Districts — Map of Assessed Values of Real Property

Assessed Values of all Real Property in each School District shows for each school district the total assessed value of the real estate in the school district. This map illustrates the great disparity in wealth among the school districts and the great disparity in the capacity to raise local funds to support the operations of local school districts. |

|

MS School Districts – Map of the Value of a Single Mill

Value of a Single Mill in each School District shows for each school district the value of a single mill. The value of a single mill is worth much in wealthier school districts than it is in low-wealth school districts. This disparity has great impact on whether the local school district has the capacity to raise local funds to meet the educational needs of the school district. |

|

MS School Districts — Map of the Number of Mills Assessed to Raise Taxes

Number of Mills Assessed by School Districts for School District Taxes shows for each school district the Millage Rate set, or the number of dollars in tax to be assessed per thousand buy zolpidem dollars of assessed value for each parcel in the district. Where a school district has land in more than one county and has set a different Mill Rate in each county, we show that on the map. |

|

Map of Property Assessment Values per Student by School District

This map on “Property Assessment Values per Student by School District” shows the dollar value per student in each school district of the real property in each school district. This data implicates the capacity of each school district to raise local funds to support public education, and illustrates the disparity in such capacity among the 149 school districts that have local tax bases. |

|

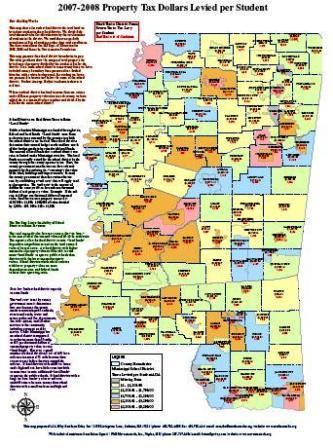

Map of Taxes Levied per Student by School District

This map on “Taxes Levied per Student by School District” shows the dollar amount of local taxes levied per student in each school district. This data shows the effort each school district has made to raise local funds through taxation to support public education. The effort to raise local funds through taxation is limited by the assessed value of real estate, limitations set by state law on local taxation for schools, and the degree of political will of local communities to support public education. |